I observe the global CR2032 battery market currently exceeds $1.5 billion USD annually, with projections indicating a value of $1.575 billion by 2026. This market shows a 5.8% Compound Annual Growth Rate from 2026 to 2033. Understanding this evolving battery market demand is crucial for strategic procurement.

Key Takeaways

- The CR2032 battery market is growing. It will reach $1.575 billion by 2026.

- This market grows by 5.8% each year. This makes understanding it important for buying decisions.

CR2032 Market Demand Drivers and Applications

Key Application Segments Fueling Demand

I observe several key application segments consistently fuel the demand for CR2032 batteries. Consumer electronics represent the largest segment, driving significant market growth. Devices like remote controls, watches, and hearing aids consistently require these compact power sources. Beyond everyday gadgets, the expansion of the Internet of Things (IoT) market plays a crucial role. The proliferation of interconnected devices across smart homes, wearables, and industrial applications necessitates numerous small, reliable power sources.

Medical devices also form a significant application segment. Advancements in medical device technology, particularly miniaturized equipment like glucose meters and portable monitors, rely heavily on the compact and reliable power that CR2032 batteries provide. The automotive sector is another key area, with applications in key fobs and tire pressure monitoring systems (TPMS). Industrial applications, including sensors and security systems, further contribute to this robust demand. This broad reliance across diverse industries underscores the CR2032′s essential role. Meeting this global demand requires robust manufacturing capabilities. For instance, Ningbo Johnson New Eletek Co., Ltd. stands as a professional source manufacturer of CR2032 batteries, exporting to over 50 countries. We operate with 20 million USD assets and a 20,000-square-meter manufacturing floor, employing over 150 skilled individuals across 5 automatic production lines. This infrastructure helps satisfy the varied needs of these critical application segments.

Global Market Value and Projected Growth for 2025-2026

I see the global CR2032 battery market is poised for continued expansion. While the overall battery market’s industry size is estimated at $183.6 billion in 2026, CR2032 batteries carve out a significant niche. The market, valued at $13.31 billion in 2025, projects to grow at a Compound Annual Growth Rate (CAGR) of 9.3% from 2026 to 2033, ultimately reaching $22.69 billion. This growth trajectory highlights the sustained importance of this specific battery type within the broader battery market demand. My analysis indicates that the CR2032 market alone is estimated to be worth over $1.5 billion USD annually, with a volume exceeding 5 billion units. This substantial market value and projected growth underscore the critical need for strategic procurement and reliable supply chains.

Reasons for High Global Demand for CR2032 Batteries

I identify several compelling reasons for the consistently high global demand for CR2032 batteries. Technological advancements are a primary driver. The ongoing miniaturization of electronics ensures a continuous need for compact power sources. The expansion of the Internet of Things (IoT) is particularly impactful; the increasing number of connected devices, from smart home appliances to industrial sensors, requires low-power, long-life batteries. CR2032 batteries, with their high energy density and long lifespan, are ideal for uninterrupted functionality in these IoT devices. Similarly, the growth of wearable technology, such as fitness trackers and smartwatches, relies on these compact, reliable, and long-lasting power solutions.

Consumer preferences also play a significant role. I observe a mature and quality-conscious market that drives high demand for reliable batteries. Consumers increasingly adopt CR2032 batteries in healthcare and IoT devices, valuing their dependable performance. Furthermore, there is a strong preference for eco-friendly and recyclable battery options, influenced by growing environmental concerns and regulatory standards. Our products at Johnson New Eletek, for example, are free from Mercury and Cadmium, completely meeting EU ROHS Directive and SGS certified. This commitment to quality and environmental responsibility aligns with evolving consumer expectations and contributes to sustained market demand. The critical applications in healthcare and automotive sectors also ensure sustained demand for high-reliability power, making the CR2032 an indispensable component.

Current Procurement Landscape and Challenges in the Battery Market Demand

Supply Chain Dynamics and Major Manufacturers

I observe the CR2032 battery supply chain involves a complex network of raw material suppliers, component manufacturers, and assemblers. Major manufacturers often control significant portions of this chain, influencing global availability and pricing. My company, Ningbo Johnson New Eletek Co., Ltd., operates as a professional source manufacturer, exporting CR2032 batteries to over 50 countries. We manage our supply chain with 20 million USD assets and a 20,000-square-meter manufacturing floor, employing over 150 skilled individuals across 5 automatic production lines. This structure helps us maintain consistent supply. However, global events and geopolitical shifts can disrupt these dynamics, impacting the overall battery market demand. Understanding these intricate relationships is crucial for stable procurement.

Price Volatility and Cost Management Strategies

I find price volatility a significant challenge in the CR2032 market. Global events, like economic downturns or supply chain disruptions, often lead to price increases. The rise of online shopping intensifies competition, offering a broader range of prices. To manage costs effectively, I recommend several strategies. Buyers should always check expiry dates before purchasing to ensure optimal performance. Reading user reviews offers valuable insights into battery performance and durability. I also advise comparing prices using various tools and watching for sales or promotions. Considering specific device needs helps maximize savings. For larger needs, wholesale buying offers significant advantages, providing up to 64% savings on alkaline AAs and 49% on lithium AAs compared to retail. A comprehensive ‘Total Power Strategy’ can further reduce costs, involving:

- Replacing high-usage device batteries with rechargeable options.

- Analyzing remaining battery needs and selecting optimal types.

- Placing a single wholesale order for 6-12 months of disposable batteries. These steps help mitigate the impact of price fluctuations on the battery market demand.

Quality Control and Compliance Standards

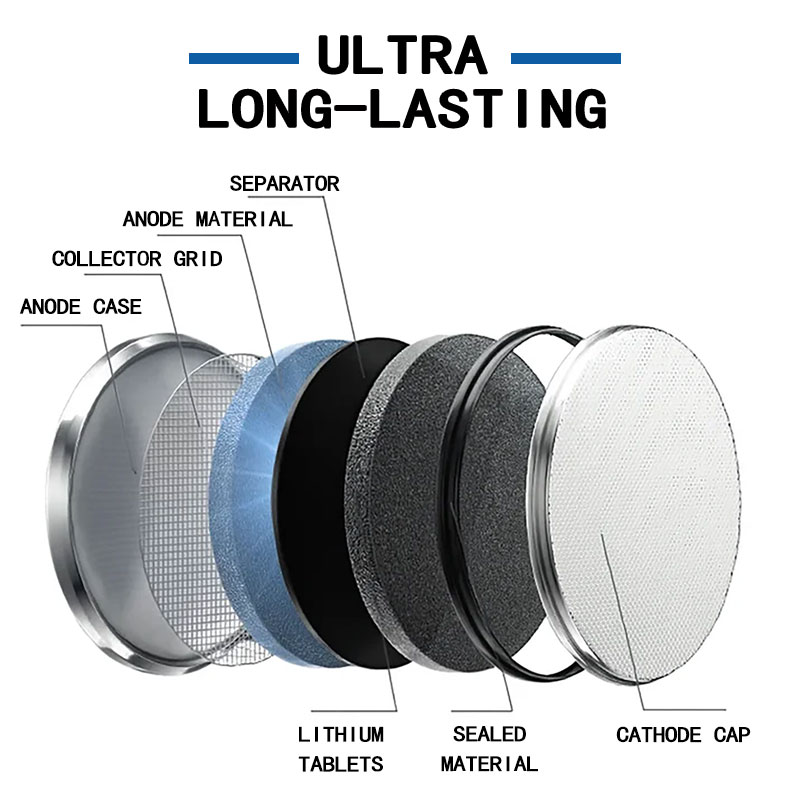

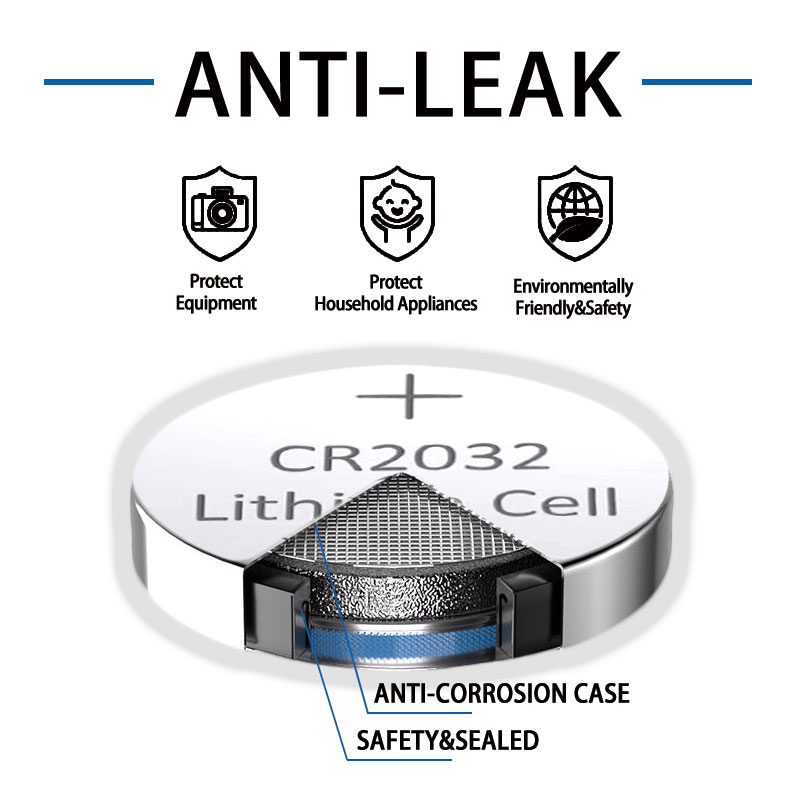

I emphasize the critical importance of quality control and compliance standards for CR2032 batteries. Buyers should prioritize brand reputation and look for a shelf life of 7+ years, indicating quality chemistry. Good batteries come in protective packaging, and certifications are essential. I advise avoiding no-name brands, bulk bins, excessively cheap prices, poor packaging, and the absence of date codes. My company’s CR2032 batteries, for example, have passed multiple international safety and environmental certifications, including CE, RoHS, UN38.3, and MSDS. They boast high energy density, a low self-discharge rate (retaining over 90% charge after 5 years), and a leak-proof structure. Regarding compliance, I note that while many CR2032 batteries fulfill RoHS compliance, not all are compliant with REACH regulations. These factors are vital for ensuring product safety and environmental responsibility in the battery market demand.

Emerging Procurement Trends for 2026

Supply Chain Resilience and Diversification

I see supply chain resilience and diversification as critical for 2026. Buyers must build robust networks to withstand disruptions. I recommend diversifying suppliers. This means establishing relationships with multiple vendors. Each vendor can serve a specific purpose. For example, one supplier might offer speed, another volume stability, and a third customization. I prioritize partners with proven quality certifications. They should also have transparent testing protocols and strong delivery performance, aiming for 98% or higher.

I select suppliers with scalable production capacity. This capacity must align with my growth trajectories. I also look for competitive, fair pricing models that include value-added services. I conduct a holistic assessment. This goes beyond just price comparison. I evaluate technical capability, operational reliability, and regulatory compliance. I ensure suppliers hold internationally recognized certifications like ISO 9001 and IEC 62133. I also request third-party test reports from accredited labs. I evaluate operational performance metrics. These include on-time delivery rates, aiming for 98% or more. I also check average response times, ideally under 3 hours, and reorder rates, which should be less than 30%. I perform virtual factory audits or on-site inspections. This verifies automation levels, cleanroom environments, and humidity-controlled storage. I request sample batches for real-world discharge tests. These tests cover various operating temperatures. I also evaluate packaging durability, labeling accuracy, and customization capabilities.

Key takeaway: Diversify suppliers, prioritize certified quality, assess holistically, and verify operational performance for a resilient supply chain.

Sustainability and Ethical Sourcing Practices

I believe sustainability and ethical sourcing will define procurement in 2026. I innovate in eco-friendly chemistries. I also develop sustainable sourcing strategies. This helps comply with stricter regulations on battery disposal and toxic materials. I invest in digital tracking and certification systems. These systems ensure transparency and traceability across the supply chain. This meets evolving compliance standards. I continuously monitor policy developments. I also invest in resilient, compliant supply chain infrastructures. This mitigates risks from supply disruptions, penalties, or product recalls.

I see exciting developments in sustainable battery manufacturing. For instance, Aqua Metals and Dragonfly Energy collaborated in September 2023. They successfully manufactured a lithium-based battery cell from sustainably recycled lithium. Aqua Metals supplied high-purity lithium hydroxide. They sourced this from recycled lithium-ion batteries. Dragonfly Energy then used its proprietary dry electrode coating technology. They produced a standard CR2032 lithium battery cell. This shows the potential for a circular economy in battery production. My products are free from Mercury and Cadmium, meeting EU ROHS Directive and SGS certified. I also ensure compliance with ethical sourcing standards. These include RoHS, REACH, CE marking, and GHS-compliant MSDS. I also consider the EU Battery Regulation, RoHS Directive, REACH SVHC Substances, IEC60086-4, and ISO/IATF certification.

Key takeaway: Embrace eco-friendly chemistries, ensure supply chain transparency, and adhere to strict ethical and environmental certifications.

Digitalization and Automation in Procurement

I recognize digitalization and automation as transformative forces in procurement. These technologies streamline processes. They also enhance decision-making. I implement advanced analytics for demand forecasting. This helps predict future needs more accurately. I also use automated systems for order placement and inventory management. This reduces manual errors and improves efficiency. Digital platforms facilitate better communication with suppliers. They also provide real-time visibility into the supply chain. This transparency allows for quicker responses to market changes.

I invest in digital tracking and certification systems. These systems ensure transparency and traceability across the supply chain. This meets evolving compliance standards. Automation can handle routine tasks. This frees up my procurement team. They can then focus on strategic initiatives. These initiatives include supplier relationship management and risk mitigation. I also explore blockchain technology. This can further enhance the security and integrity of procurement data.

Key takeaway: Leverage digital tools and automation for enhanced forecasting, efficient operations, and transparent supply chain management.

Long-Term Contracts and Strategic Partnerships

I advocate for long-term contracts and strategic partnerships. These arrangements provide stability and mutual benefits. They foster stronger relationships with key suppliers. This leads to better pricing, guaranteed supply, and collaborative innovation. I seek partners who share my vision for quality and sustainability.

I look at successful collaborations as models. For example, Dragonfly Energy Holdings Corp. and Aqua Metals formed a strategic partnership. Their objective was to manufacture a lithium-based battery cell using recycled materials. Aqua Metals contributed high-purity lithium hydroxide. They recovered this from recycled lithium-ion batteries. Dragonfly Energy then used the recovered lithium hydroxide. They produced a standard CR2032 cell with their patented dry powder coating process. This demonstrated that sustainably recycled materials can meet high standards for advanced battery cell production. This paves the way for a circular and sustainable lithium battery manufacturing industry. It also supports a domestic battery supply chain. I believe such partnerships are crucial for securing competitive advantages. They also help meet future market needs effectively.

Key takeaway: Form long-term contracts and strategic alliances for stability, innovation, and a sustainable supply chain.

Strategic Recommendations for Buyers and Suppliers

Optimizing Sourcing Strategies for Buyers

I believe buyers must refine their sourcing strategies for CR2032 batteries. I recommend starting with suppliers in Guangdong or Zhejiang provinces. These regions offer proven infrastructure and export readiness. I prioritize manufacturers with ISO and RoHS certifications. This is especially important for EU and North American markets. I always validate claims with sample testing and third-party audits. I balance price with delivery reliability, response time, and reorder rate. This helps me identify truly dependable partners. I build long-term relationships with one to two primary suppliers. This ensures supply continuity and preferential terms. For bulk procurement, I focus on OEM suppliers. They often manufacture branded cells and offer private-label options. These options provide identical quality at lower costs. For custom or industrial use, I evaluate manufacturers’ consistency. I check their ability to meet nominal capacity (typically 220–240 mAh). Third-party lab verification helps me confirm this. For cost-sensitive projects, I work with certified OEMs. They provide equivalent-grade cells with full documentation and traceability. I consider the total cost of a button cell. This includes reliability, warranty support, and replacement logistics. The unit price is not the only factor.

Key takeaway: Prioritize certified, reliable OEM suppliers, validate claims, and build long-term partnerships for optimal sourcing.

Adapting to Evolving Demand for Suppliers

I see suppliers must adapt to evolving market demands. I focus on improving energy density. New manufacturing techniques enhance the energy capacity of CR2032 batteries. This leads to longer device usage. Rechargeable versions of CR2032 batteries are emerging. They offer alternatives to traditional single-use batteries. I also implement sustainability initiatives. Manufacturers increasingly focus on developing environmentally friendly CR2032 batteries. I enhance battery safety, longevity, and environmental sustainability. Improved chemistries help achieve higher energy density. I integrate smart features for better device compatibility. I implement eco-friendly manufacturing practices to meet regulatory standards. My company develops environmentally friendly chemistries. We introduce smart battery management systems. We also focus on recycling initiatives and sustainable production. I develop next-generation solid-state batteries. I integrate IoT-compatible smart features. I implement eco-friendly recycling and production techniques.

Key takeaway: Innovate with higher energy density, rechargeable options, smart features, and sustainable practices to meet future demand.

I conclude the CR2032 market in 2026 will demonstrate robust demand and evolving procurement trends. I believe stakeholders must proactively engage with supply chain resilience, sustainability, and digital transformation. I know securing competitive advantages and effectively meeting future market needs demands strategic foresight. This approach ensures continued success.

FAQ

What drives CR2032 battery demand?

I see demand driven by consumer electronics, IoT devices, medical equipment, and automotive applications. Miniaturization and reliability are key factors.

How do I manage CR2032 price volatility?

I recommend comparing prices, buying wholesale, and implementing a ‘Total Power Strategy’. This includes using rechargeable options for high-usage devices.

What are key procurement trends for 2026?

I identify supply chain resilience, sustainability, digitalization, and long-term strategic partnerships as crucial trends. These ensure stable and ethical sourcing.

Post time: Jan-04-2026